|

||

1) MARKET SUMMARY: Excerpted from Thursday's paid content of "The Daily" by Jon Johnson at InvestmentHouse.com. To get his latest information and his daily content, click here now to receive a two-week trial and save $30/month. (You won't find this offer on the Investment House website. It is exclusively for The Weekender subscribers!) Inflation Returns.

|

||

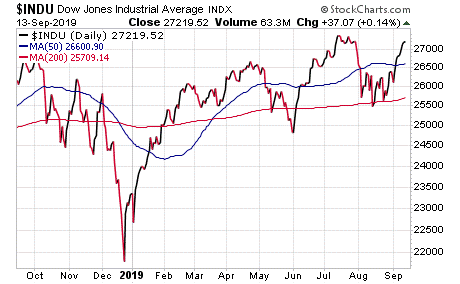

Market Summary (continued from above) The trade news on Wednesday did provide some upside impetus, but not the caliber that was indicated from the futures surge that night. Instead, the stock indices gapped higher and rallied a bit more with the S&P 500 roughly seven points from its prior all-time high. Meanwhile, the DJ30 closed within 100 points of its all-time peak. In other words, it was not a powerful surge. As noted, the indicies gapped upside, rallied and then faded to the opening prices. While we can still get quite solid gains even though the indexes are a bit lethargic, we will have to tap at them from a distance versus running up and trying to kick the door in. Not only did President Trump's comments about forestalling higher tariffs on $250 billion of goods for two weeks make an impact on the markets, the Chinese government supposedly stated that it was thinking of loosening its ban on importing U.S. agricultural products. S&P500: It gapped to a tight doji and came within eight points of the all-time high, experienced a solid volume and then moved up a bit more. While there may have been some churn, there is nothing nefarious about this move. Instead, it was just some solid upside that had simply got a bit extended. However, the index can get even more extended upside and break to a new high. Then, after that move runs its course after a few sessions, a test of the break will set up new upside opportunities. NASDAQ: It gapped over the April 2019 and August 2018 highs. Then, it moved into the July range which holds the all-time high before backing off to a doji. While this is evidence of a good move in progress, the NASDAQ is still lagging behind the other large cap indices by a bit. NOTE: The figures and information above are from the 9/11 report. Watch Market Overview Video Watch Technical Summary Video Watch Next Session Video NOTE: The videos are from the 9/10 report. Here are some trades from "The Daily," offering insights into our trading strategy and the targets that we have hit this week: Targets Hit This Week: With the nice surge from the bottom of the trading range to the verge of new highs, of course it was a week to bank gain – upside AND downside. Upside: Carbo Ceramics Inc.(NYSE:CRR): We saw CRR setting up at the 50-day moving average (MA) last weekend and starting a break higher on some good volume. We then decided to put it on the report as the oil and gas sector has formed up well for at least some short rallies. On Monday, CRR hit the entry point with a solid move and we picked up the stock for $1.87. This proved to be a good, clean pick as CRR surged into Thursday and rallied to test the 200-day simple moving average (SMA). That rang the bell on our target, and as CRR was just below the 200-day SMA with a doji, we sold the position for $2.66 and banked a gain of 42%. Now, we will have to see if CRR will form up a good pattern at the 200-day SMA. Nordstrom, Inc.(NYSE:JWN) : While several market leaders in the retail sector have hit new highs, other areas of retail have "turned the corner" after long declines. Now, they are breaking downward trends and posting excellent moves. We always watch for these stocks as the returns can be significant in a short period of time. We saw JWN over the weekend and put it on the report. On Monday, JWN continued its break over the 50-day MA and we bought some stock at $31.86 and some October $30.00 call options for $2.80. The momentum on the turn from the lows -- and a nifty little inverted head and shoulders -- was strong. Then, JWN ran right up to near our target by Thursday. It was showing a doji, and after a seven-session move higher, that was a good signal to bank some gains. So, we sold some stock for $34.64 and an 8.71% gain. We also sold part of the options for $5.00 and banked a 78% gain. Nvidia Corporation (NASDAQ:NVDA): We watched NVDA form a long six-month triangle base and waited for an entry. In late August, it put in a higher low at the 200-day SMA inside the pattern. We always watch for that because a higher low at such support typically leads to a breakout move from the pattern. So, when NVDA broke higher off the 200-day SMA on 8/29, we moved in with some October $165.00 call options for $10.55. While NVDA moved higher, it then tested once more in the base and experienced a short dip to the 50-day MA. From there it shot higher and broke out from the pattern two Thursdays ago. NVDA then walked higher into Thursday, gapped upside and brushed our target. We sold some options for $22.05 and banked 110%. Texas Instruments Inc. (NASDAQ: TXN): TXN broke higher from a two-month triangle on 9/5, but could not move forward. It tested into Tuesday and then came back to test the trendline and the 10-day exponential moving average (EMA). We saw that move and recognized it as a great entry for a continued breakout move -- chips were strong and we assumed that TXN would follow higher. As a result, we picked up some October $125.00 call options for $4.85. Then, TXN made a quick move higher into Thursday. While it still looked strong, many chips were stalling after good moves. So, we banked half the options for $6.95 and took a 43% gain in less than three sessions. If this pattern continues, we still have half the position to carry us forward. Urban Outfitters, Inc. (NASDAQ:URBN): This is another one of those retailers that trended lower before finally turning the corner so that it could be ready to rally. We saw URBN break the 50-day MA a week earlier before it then faded to the test. After it showed a nice tight doji last Wednesday, we put it on the report. On 9/5, URBN surged off the test and we moved in with some stock at $24.71 and some October $23.00 call options for $2.40. URBN made one test during the next session and then it was all upside into Thursday. After the stock showed a doji on Thursday after the strong move, it was time to bank some gains. As a result, we sold some stock for $26.51 and a 7.2% gain. We also sold half the options for $3.70 and banked 54%. Downside: Arena Pharmaceuticals, Inc. (NASDAQ: ARNA): ARNA crashed the 50-day MA in early August after a steady rally up the 20-day MA. We then watched it recover and then stall when it got back to the 50-day MA. We put it on the report when it started to stall. Two sessions later, RNA broke lower and failed in its recovery attempt. Then, we moved in with some October $55.00 put options for $4.60. It was a slow process, but ARNA steadily sold below the 10-day EMA into Tuesday. This was when it hit the 200-day SMA and held. Since this was our target, we sold the options for $6.50 and a 40% gain. American Express Company (NYSE: AXP) : AXP was an exhausting downside play. We entered as it reversed an upside move, breaking below the 50-day MA the day after it jumped off that support. We entered with some September $120.00 puts for $2.46 on 8/14. That was the start of the volatile odyssey as AXP initally sold and then reversed again back over the 50-day MA. It then gapped lower below the 50-day MA during the next session. Then, it dove lower during the last half of August and then bounced back and forth below the 20-day EMA for over two weeks, constantly and slowly trending ever lower. Finally on Tuesday, AXP gapped and sold back to the prior lows. When it held at this position, we sold the puts for $3.30 and banked a 34% gain that was barely worth the amount of time we spent watching this play. Verisign, Inc. (NASDAQ:VRSN) : VRSN made us so much money on its incredible long run upward. When it broke the 50-day MA in early August, we saw the stock's character change. Thus, we flipped our attention to using VRSN to make us money on the downside. It tested the move with a bear flag that stalled at the 50-day MA. We put it on the report and it gapped down from the 50-day MA on 8/12. At this point, we entered with some October $210.00 put options for $10.80. VRSN immediately rebounded to test the 50-day MA again. From there, it gapped to a lower low -- ah the volatility -- and having a spread to churn on it would have been great. VRSN then bounced up and down -- always below the 50-day MA -- for the next three weeks. This week, VRSN finally gave up after wearing itself out. It tumbled on Monday, Tuesday and Wednesday and finally hit our target when the markets closed on Wednesday. Since we saw a support in the form of the rising 200-day MA, we sold the position for $18.85 and a gain of 74%. Receive a two week trial and if you stay on receive a $30 per month discount! |

||

2) IH ALERTS NYSE:GS (Goldman Sachs--$207.21; +0.15; optionable) Company Profile EARNINGS: 10/15/2019 STATUS: Goldman showed a doji on Friday after a nice Thursday gap higher through the 50-day EMA and up to the 50-day SMA. The stock then paused with a doji on Friday and took a breather after an important move. After all, that move on Thursday gapped GS over the four-week range which had formed over the 200-day SMA after the early August meltdown. We want to play a resumption of the break higher up to the bottom of the late July lateral consolidation range. That move will give us a solid 75% gain on the options. VOLUME: 1.439M Avg Volume: 2.073M BUY POINT: $208.28 Volume=3.1M Target=$218.31 Stop=$204.92 POSITION: GS OCT 18 2019 210.00C - (45 delta) &/or Stock Video CHART IMAGE Save $600 per year and enjoy a two week trial of our IH Alerts Service! |

||

3) SUCCESS TRADING GROUP -- by the MarketFN STG Team NASDAQ:LSCC (Lattice Semiconductor Corp.) Company Profile Our Success Trading Group members scored another winning trade when we closed out a position in Lattice Semiconductor Corp. (NASDAQ: LSCC). We are watching several other stocks and are looking forward to trading next week. Our Success Trading Group closed seven years with zero losses on our Main Trade Table. In fact, we closed 100% winning trades for the calendar years 2016, 2015, 2013, 2012, 2011, 2010 and 2009. We still have one open position from 2017 (all others were winners) and one trade that we opened in 2014 but was closed as a losing trade. All of these trades are posted on our Main Trade Table for your review during your free membership trial period. Get Our Next Trade Free - Save $50 per month! Details Here. |

||

4) COVERED CALL PLAY Seabridge Gold Inc. (NYSE:SA) -- Seabridge Gold Inc. is currently trading at $13.49. The November 16 $13.00 Calls (SA20191116C00013000) are trading at $1.25. That provides a return of about 10% if SA is above $13.00 by the time of the expiration. Company Profile Learn more about our Covered Call Tables |

||

|

||

The foregoing is commentary for informational purposes only. All statements and expressions are the opinions of Online Investment Services, LP., or Split Ventures, Ltd. This information is not meant to be a solicitation or recommendation to buy, sell, or hold securities. We are not licensed or registered in the securities industry. The information presented herein and on the related web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The security portfolios of writers for this issue may, in some instances, include securities mentioned herein and on the related web site. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ materially due to many factors. No one associated herewith receives compensation in any manner from any of the companies that are discussed in this newsletter or on the related websites. This is a commerical email. It may contain advertisment or solicitation. This email was sent to ~~EMAIL~~. Please click the following link to change or unsubscribe. All Rights Reserved. 300 New Jersey Ave, Suite #500, Washington, DC 20001 |

||

|

Monday, September 16, 2019

Weekender 9/15

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment