Informing Investors Around The World

Read In All 50 States And Over 100 Countries

You have earned ~~VIP~~ points worth $~~VIP~~ Click here for details*

Weekend Newsletter for

August 25, 2019

Table Of Contents

1) MARKET SUMMARY from THE DAILY

2) IH ALERTS

3) SUCCESS TRADING GROUP

4) COVERED CALL SERVICE

1) MARKET SUMMARY:

Excerpted from Wednesday’s paid content of “The Daily” by Jon Johnson at InvestmentHouse.com. To get his latest information and his daily content, click here now to receive a two-week trial and save $30/month. (You won’t find this offer on the Investment House website. It is exclusively for The Weekender subscribers!)

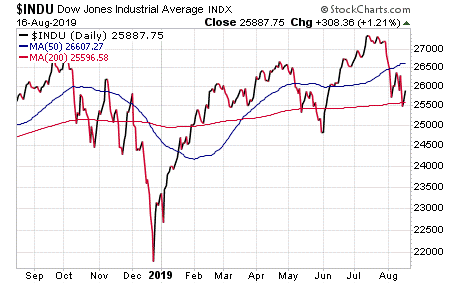

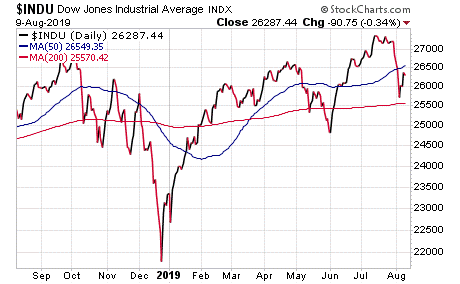

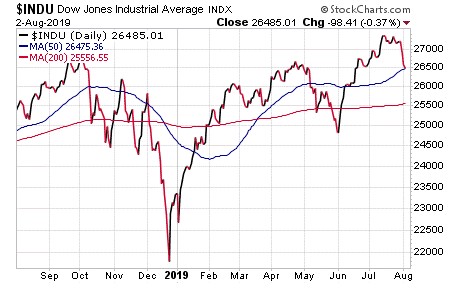

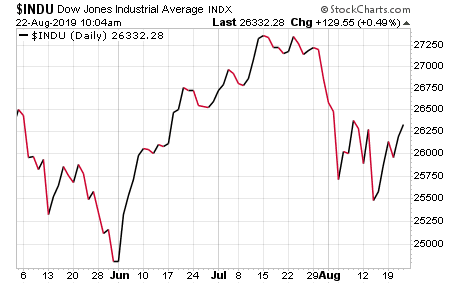

Stocks Bounce After Inverted Yield Curve

Stocks bounce right back from the Tuesday test.

Retail earnings lead the surge back upside.

FOMC minutes echo Powell’s ‘midcourse adjustment’ comments but still taken as a positive.

Indices are up another session but after all the work are still in the range.

Bond curve temporarily inverts again, no one cares. That happens.

Still work to do: Powell Friday, indices not breaking from the range. Putting all the bets on Powell to tap dance well for the market.

Market Summary (continued from above)

Earnings are still having an impact and a positive one. That happens when expectations are low as in Lowe’s. No one expected a quarter where it outshined HD. It did. TGT’s metrics were not supposed to come close to WMT. TGT destroyed all estimates. It rallied over 20%. Consumers are not showing, at least through June, any fear of recession – at the discount stores and home improvement. Look at motor homes and RV’s and you see a big drop in sales of the magnitude that has preceded the last 3 recessions.

Afterhours JWN earnings beat and that stock is higher. LB jumped at first but now trades lower; not horribly so, but lower. Perhaps JWN – expectations cannot really get lower – will also provide upside impetus. Indeed, SPY futures rallied after the close.

They also rallied before the open. Futures gapped upside on those retail earnings from TGT and LOW. Even misses such as URBN were rewarded with gains. The power of a nice surprise when nothing of note was expected.

SP500, NASDAQ, DJ30: All up after the rather innocuous Wednesday fade, but all at the 50 day MA/gap point, all showing doji, all showing even lower volume. They remain at the lick log as I like to say as a holdover from my litigation days.

NOTE: The figures and information above are from the 8/21 report.

Watch Market Overview Video

Watch Technical Summary Video

Watch Next Session Video

NOTE: The videos are from the 8/21 report.

Here are two trades from “The Daily,” offering insights into our trading strategy and the targets that we have hit this week:

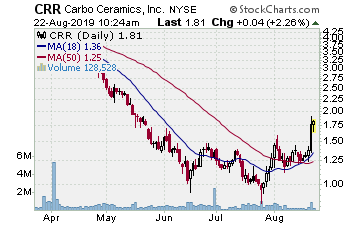

Chart by StockCharts.com

Carbo Ceramics (NYSE:CRR)

Company Profile

Double bottom with a handle. Things are so bad in oil that some are good. CRR

provides proppants for hydraulic fracturing used in horizontal drilling. Over the past 2

months CRR has formed a double bottom with handle pattern as MACD has risen in an

uptrend. Lower price lows while MACD makes a higher low — that signals momentum

turning upside. Not saying it is time to fall in love with energy, but it CRR delivers a break

upside from this pattern it has room to move. A run to the initial target gains 48%.

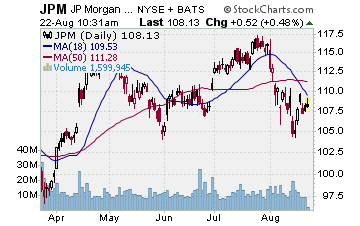

JP Morgan (NYSE:JPM)

Company Profile

Chart by StockCharts.com

JPM put in a double top from early May to a second top in late July. Gapped

through the 50 day MA’s 8/5 and sold off to the 200 day SMA. Tried to hold then last

Wednesday JPM gapped through the 200 day SMA. With the Thursday and Friday

recovery JPM worked back up through the 200 day SMA and Monday gapped up near the

20 day EMA and near the top of the 2 week range. Faded to the 10 day EMA to close. If

JPM turns back down from here in general market weakness and renewed worries

regarding the interest rate situation (i.e. heading lower), we want to move in to some puts

for the downside. A move to the target gains 80%ish on the put options.

Targets Hit This Week:

Palomar Holdings Inc. (NASDAQ: PLMR): Not all great plays are household names that everyone recognizes. New can be, and often is, good. PLMR was a new issue in April. We always look at the first base breakout to give us an entry in a new issue because they usually yield nice gains. After its IPO, PLMR rallied to mid-May then moved laterally in a tight range for all of June and half of July. Then it started to show life, trying to make a breakout form that trading range. We put it on the report 7/19, the day it started to break higher. It edged just barely upside after that day, however, not really showing a clean break. That came, however, about a week later when it jumped up off the 10 day EMA on volume. On 7/30, the stock broke higher again and traded at $27.81 early. This stock had no options, so it was a stock only play. Once again PLM worked laterally after that move. On day five, it was up again then the same action, that slow slide laterally. Finally, a strong surge on 8/13 posting a 15% move. PLMR continued upside through Monday, gapping upside then reversing. After this kind of run that is the signal to take at least some gain. The stock was trading $36.91, fading off a gap higher; time to exit. That move gained a solid 32% on the stock

American Tower Corp. (NYSE: AMT): AMT is always a stock to watch when it sets up a pattern. And in July it did just that, a double bottom test of the 50 day MA up to the end of the month. It broke higher, stalled a bit and we used that stall to put it on the report on 8/5. The next session it was up again and time to enter. The stock asked $215.11 and the Sept. 6 $215.00 strike calls were $6.30. Sept. 6 expiration made sense given AMT’s earnings are 10/30 and there were no plans to ride it through the results. AMT continued upside the following session though the action was wild – needed to keep the bicarbonate close. The stock continued higher through the week. It then started to test the 2 week move from late July – it had rallied before we entered. AMT tested back to the 10 day EMA through 8/14, a 3-day test. It then surged the next session and climbed – with some volatility again – into this week. A good move Wednesday was followed by a gap upside Thursday and then some weakness. The options were up strong at 12.50 x 13.40 and the play had hit the target. Time to bank the gain. With a 12.85 trade it turned in a solid 100+% gain.

Receive a two week trial and if you stay on receive a $30 per month discount!

Chart by StockCharts.com

2) IH ALERTS

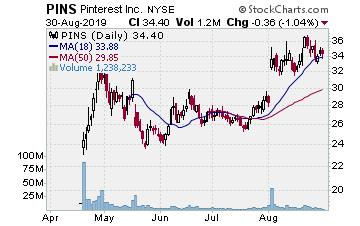

NYSE:PINS (Pinterest–$33.43; +0.03; optionable): Social

Company Profile

EARNINGS: 10/31/2019

STATUS: Pennant/Flag. A new issue in May, we are already playing PINS and are ready to put more money to work on the stock as it makes the new break higher. PINS rallied off the IPO then starting Ma formed a cup base. We picked up positions on the break higher the second half of July and enjoyed the earnings surge. Now, we want to move in when PINS completes this test of its gap upside. That could have been Thursday — the stock tested near the 10 day EMA and jumped nicely higher. Friday it was up again but slipped back to close basically flat. May want to test/consolidate the gap a bit more, letting the 10 day EMA (31.53) catch up to it. We will be patient and play it whether it fades more, moves laterally, or simply jumps higher through the entry point. A move to the target gains 14%ish on the stock, 60%ish on the options.

Volume: 2.642M Avg Volume: 4.222M

BUY POINT: $33.78 Volume=6.2M Target=$38.45 Stop=$32.23

POSITION: PINS NOV 15 2019 34.00C – (54 delta) &/or Stock

CHART IMAGE

Save $600 per year and enjoy a two week trial of our IH Alerts Service!

Chart by StockCharts.com

3) SUCCESS TRADING GROUP

— by the MarketFN STG Team

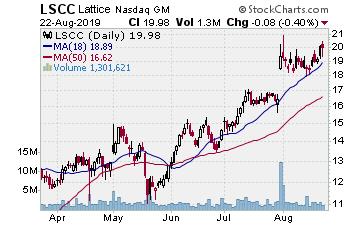

NASDAQ:LSCC (Lattice Semiconductor Corp.)

Company Profile

Our Success Trading Group members scored another winning trade when we closed out a position in Lattice Semiconductor Corp. (NASDAQ:LSCC). We are watching several other stocks and are looking forward to trading next week.

Our Success Trading Group closed seven years with zero losses on our Main Trade Table. In fact, we closed 100% winning trades for the calendar years 2016, 2015, 2013, 2012, 2011, 2010 and 2009. We still have one open position from 2017 (all others were winners) and one trade that we opened in 2014 but was closed as a losing trade.

All of these trades are posted on our Main Trade Table for your review during your free membership trial period.

Get Our Next Trade Free – Save $50 per month! Details Here.

Chart by StockCharts.com

4) COVERED CALL PLAY

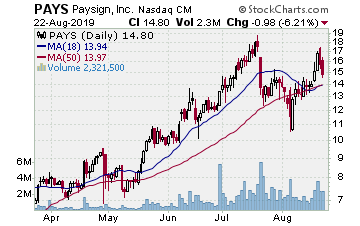

NASDAQ:PAYS — Paysign Inc. is currently trading at $41.19. The Oct. 19 $41.00 Calls (CIEN20191019C00041000) are trading at $3.05. That provides a return of about 8% if LSCC is above $41.00 by the time of the expiration.

Company Profile

Learn more about our Covered Call Tables

PREMIUM SERVICES

IH Alerts: InvestmentHouse.com’s Best of The Best Plays!

Stock Split Report: Forbes.com Best of the Web

Covered Calls: Allowed in your IRA – Energize your portfolio!

The Daily: “The Daily” is a must read for all investors!

Success Trading Group: seven years without a trading loss!

The foregoing is commentary for informational purposes only. All statements and expressions are the opinions of Online Investment Services, LP., or Split Ventures, Ltd. This information is not meant to be a solicitation or recommendation to buy, sell, or hold securities. We are not licensed or registered in the securities industry. The information presented herein and on the related web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The security portfolios of writers for this issue may, in some instances, include securities mentioned herein and on the related web site. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ materially due to many factors. No one associated herewith receives compensation in any manner from any of the companies that are discussed in this newsletter or on the related websites.

This is a commerical email. It may contain advertisment or solicitation. This email was sent to ~~EMAIL~~. Please click the following link to change or unsubscribe. All Rights Reserved. 300 New Jersey Ave, Suite #500, Washington, DC 20001

NOTE: You have ~~VIP~~ VIP Points!

* Each VIP Point is worth $1 off the price of any of our monthly subscription newsletters